During the early days of the COVID-19 pandemic, homeowners nationwide used their spare time to tackle overdue home projects. As the year continued, a combination of factors, including low interest rates and rising home prices, helped fuel a surge in home renovations, improvements, and remodels.

These trends continued into 2022, but recent data from the Joint Center for Housing Studies of Harvard University suggests the home improvement boom might finally be over. According to its July 2023 report, a combination of higher interest rates, lower home prices, and a slower pace of home sales will likely lead to a 5.9% drop in residential improvement and maintenance spending through Q2 in the coming year.

U.S. Home Improvement Spending Over Time

Home improvement spending surged over the past 10 years

Source: Construction Coverage analysis of U.S. Bureau of Economic Analysis & U.S. Bureau of Labor Statistics data | Image Credit: Construction Coverage

After falling by an inflation-adjusted 24% from a high in 2006 to a low in 2011 as a result of the Great Recession, home improvement spending growth got back on track between 2012 and 2019 as the housing market recovered. However, spending then grew sharply during the peak of the COVID-19 pandemic before plateauing in 2022. According to loan-level data from the Home Mortgage Disclosure Act, the number of single-family home improvement loans originated climbed to nearly 750,000 in 2022, up from approximately 550,000 in 2021.

Typically, home improvement spending falls during economic downturns; however, the COVID-19 recession proved to be an exception to the rule. One key reason is that the early stages of the pandemic disproportionately impacted lower-wage workers who were less likely to own homes. Meanwhile, higher-income homeowners didn’t suffer the same level of job losses or reduced wages but benefited from reduced spending on things like eating out and travel, which freed up funds for other expenses. With many of these homeowners spending more time at home, they were eager to create home offices, gyms, and backyard oases featuring decks, outdoor kitchens, and pools.

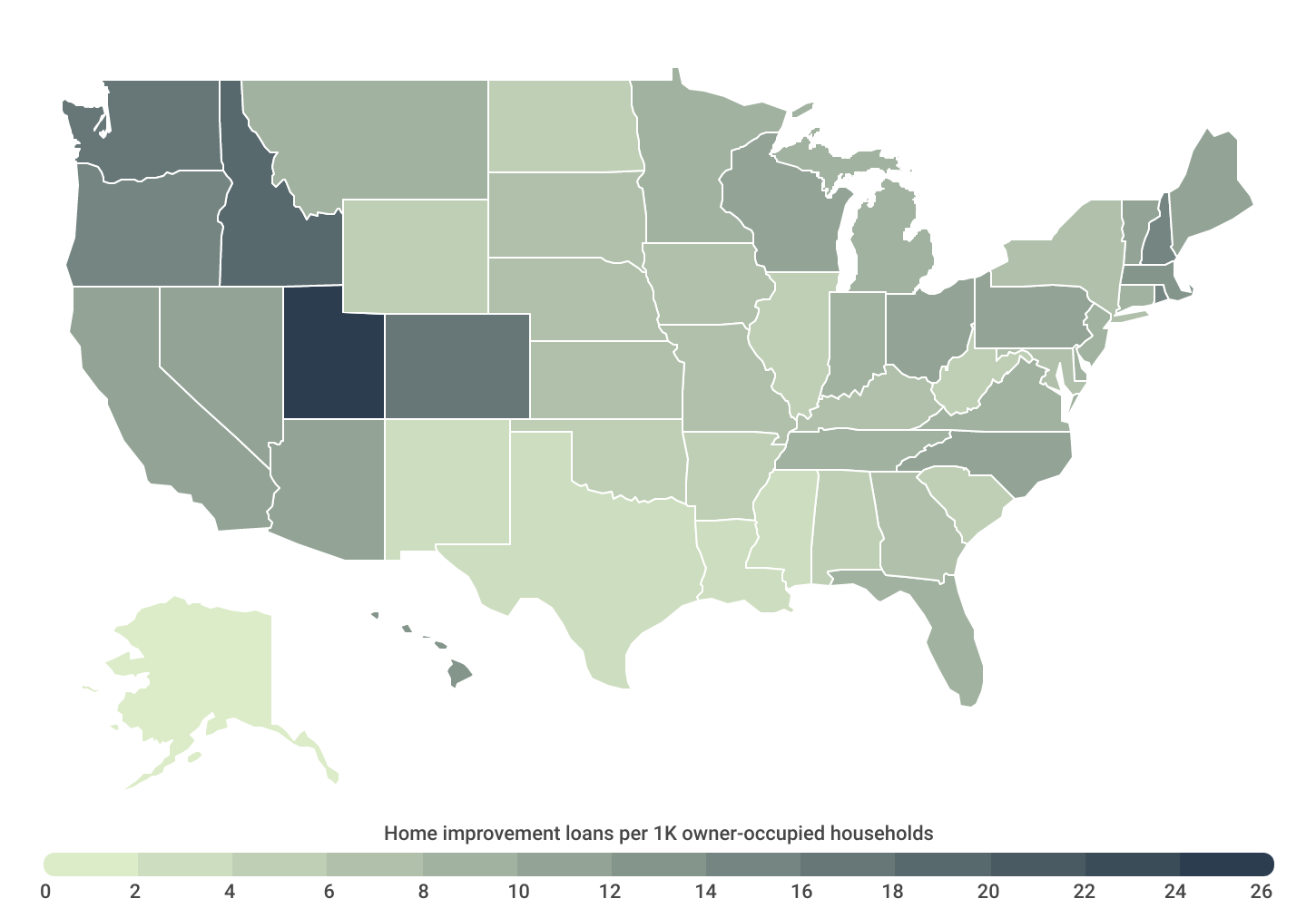

Home Improvement Loan Approvals by Location

Utah residents invested most in home improvements in 2022

|

Source: Construction Coverage analysis of Home Mortgage Disclosure Act data | Image Credit: Construction Coverage

Investing in home improvements varies by location due to factors such as cost of living, local economic conditions, and the housing market. Notably, the Pacific Northwest, Mountain West, and New England stand out for their high spending in 2022.

At the state level, homeowners in Utah and Idaho—two of the top 10 fastest-growing states—took out the most home improvement loans per capita, at 26.0 and 18.9 loans per 1,000 homeowners, respectively. Other top states include neighboring Colorado, Washington, and Oregon, as well as Rhode Island, New Hampshire, Massachusetts, and Vermont in New England. At the other end of the spectrum, homeowners in Alaska took out the fewest home improvement loans, at just 1.6 loans per 1,000 homeowners.

Similar trends hold at the local level where fast-growing parts of Utah, Idaho, Colorado, Washington, and Oregon claim many of the top spots for home improvement spending. The Salt Lake City metro ranks first among large metros, Provo, UT claims the top spot among midsize metros, and Coeur d’Alene, ID sits at the top of the small metros list followed closely by Logan, UT.

Analyzing the latest data from the FFIEC, the U.S. Census Bureau, and Zillow, researchers at Construction Coverage ranked metros and states according to the number of home improvement loans per 1,000 owner-occupied households. Here is a summary of the data for Kentucky:

- Home improvement loans per 1K owner-occupied households: 7.3

- Total annual home improvement loans: 9,229

- Median loan amount: $55,000

- Median interest rate: 4.95%

- Median home price: $197,657

For reference, here are the statistics for the entire United States:

- Home improvement loans per 1K owner-occupied households: 8.8

- Total annual home improvement loans: 744,717

- Median loan amount: $75,000

- Median interest rate: 4.75%

- Median home price: $349,770

For more information, a detailed methodology, and complete results, see U.S. Cities Investing the Most in Home Improvements on Construction Coverage.

Read the full article here